Loan Basics

Loan Properties

Every GONDI loan has:

Principal Amount: Loan size (in WETH or USDC)

Gross APR: Annual percentage rate

Due Date: Repayment deadline to avoid default

Origination Fee: Optional upfront fee (deducted from principal)

Collateral: Your NFT (ERC-721s, ERC-1155s, legacy ERC-721s)

Pro Rata Interest

Interest only accrues while your loan is active. Repay early to save on interest costs - no penalties for early repayment.

Loan Example

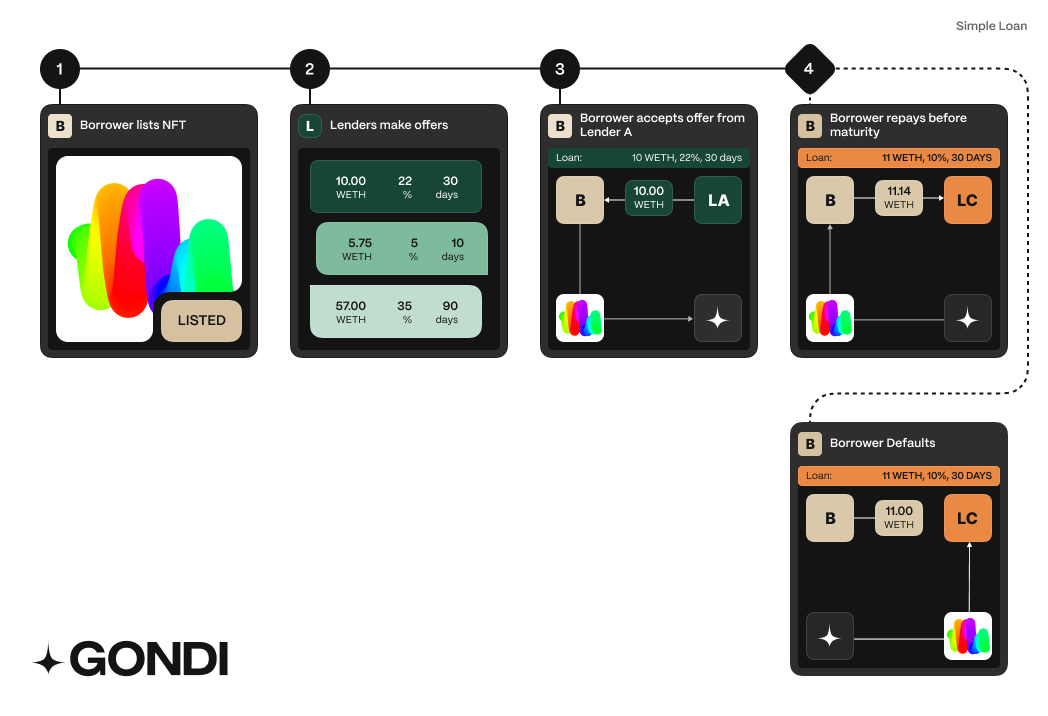

How Loans Work

Browse: List your NFT to see available offers

Select: Choose loan amount and terms - GONDI automatically finds the cheapest combination

Receive Funds: Get principal minus any origination fees; your NFT goes to escrow

Repay: Pay back principal plus interest before due date to retrieve your NFT

Default: If unpaid by due date, lenders can claim your NFT through liquidation

Repayment Rules

Full repayment only: Must pay principal + all accrued interest at once

No partial payments: Installments not supported

Anytime before due date: No early repayment penalties

Last updated